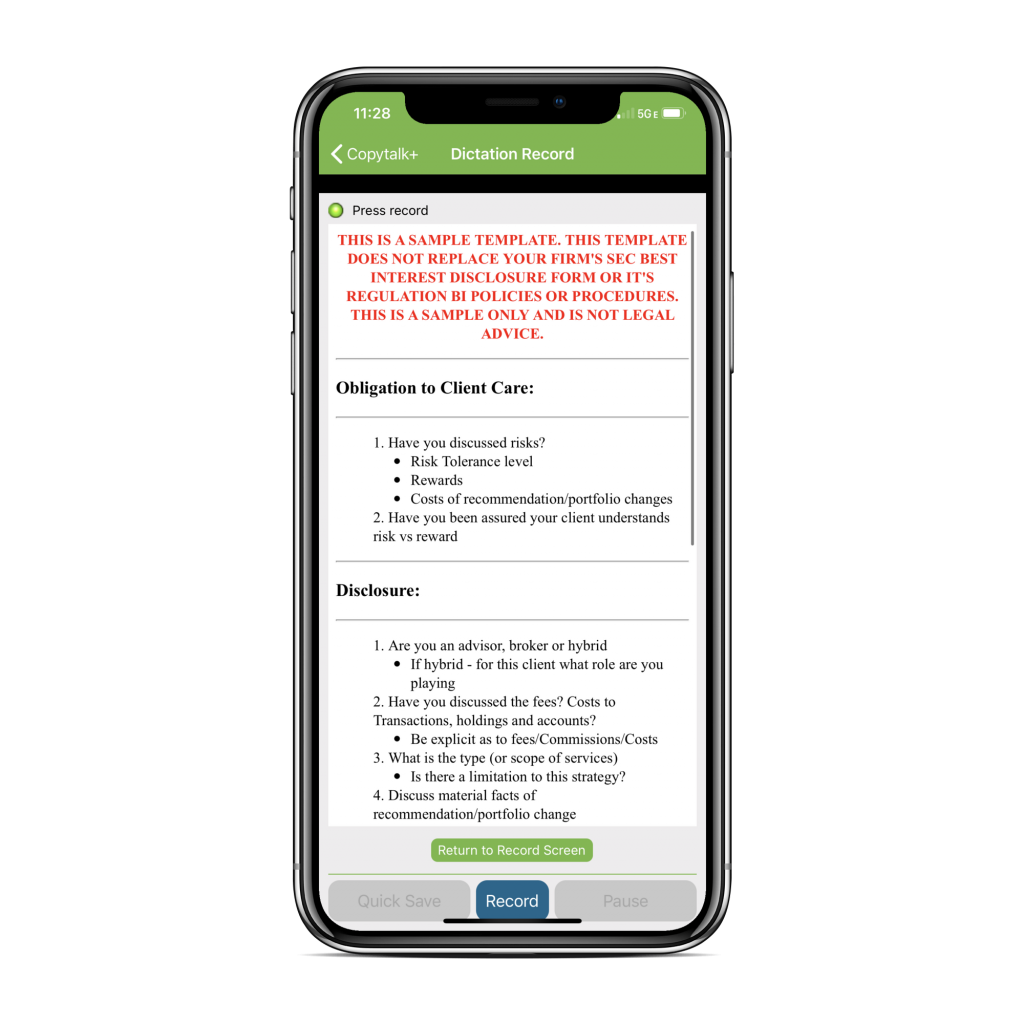

As you are dictating, first instruct your operator to do the following:

Instruct operator that this is a Reg BI template.

Instruct the operator to make each question bold and your responses to the question in regular text.

Instruct operator after each answer to skip a line and start a new paragraph.

Sample Dictation:

Operator this is a Reg BI template. Make each question bold and responses in regular text. After each answer, skip a line and start a new paragraph.

Obligation to client care:

Question One: Have you discussed risks, both the risk tolerance level versus the reward and the cost of the recommendations?

My response: Yes, we discussed the risk tolerance level to be moderate. They’re looking for a balanced portfolio between some growth and some income. The rewards of doing this is that they get some growth, but they have some protection on the downside. The cost of the recommendation for this portfolio is a 3% fee. The clients understand the cost involved, as well as the overview of what the portfolio can potentially do within their existing portfolio.

Disclosures:

Question One: Are you an advisor, broker, or hybrid?

In this particular — for this particular client, I am acting as a broker.

Question Two: Have you discussed the fees, cost of transactions, holdings, and accounts?

Yes, we discussed the fees at a 3%. That’s the cost of the transactions. There’s no other fees to the account, except that whatever portion they have in an IRA, that will be an additional annual fee.

Question Three: What is the type or scope of services?

My response is that the type of these services are limited to this strategy only. They have other holdings with another brokerage house that at this time, we are not going to oversee. But we did analyze that portfolio and this complements it very well.

Number Four: Have you discussed material facts of recommendation and portfolio change?

In this particular instance, there is no portfolio change. This is a new client.

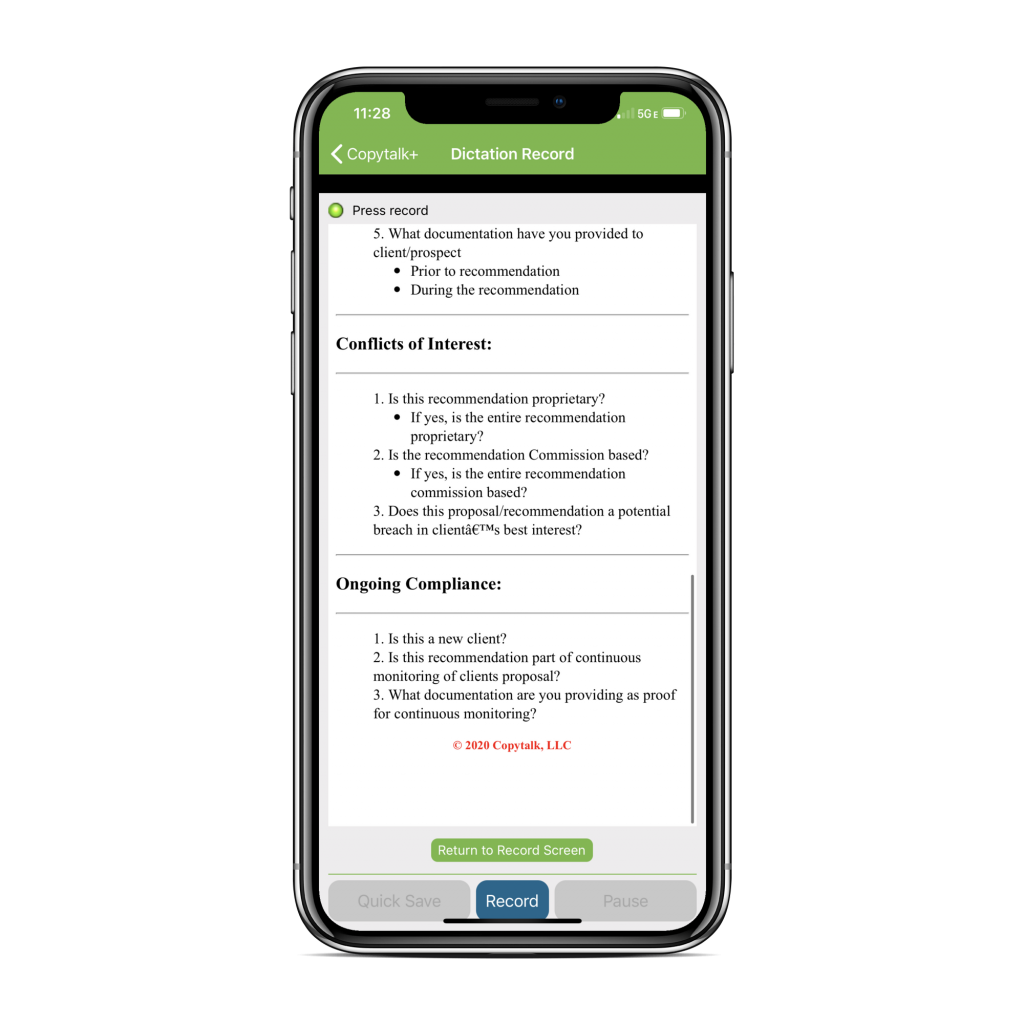

Number Five: What documentation have you provided to the client, either prior or during the recommendation?

I have provided to the client both the risk tolerance questionnaire, their full review of their current portfolio, and what this suggested portfolio or additional to their portfolio can balance out their other factors in their financial planning. I have also provided the new account information and the disclosure forms for CRS and Reg BI.

Conflicts of interest:

Question One: Is this recommendation proprietary?

No, the recommendation is not a proprietary recommendation.

Question Two: Is the recommendation commission-based?

Yes, it is commission-based. This recommendation is a 3% fee.

Number Three: Does the proposal or recommendation a potential breach in client’s best interest?

No, absolutely not. The proposal is in the client’s best interest to well round out their existing portfolio.

Ongoing compliance:

Question One: Is this a new client?

Yes, this is a new client for our firm.

Question Two: Is this recommendation part of continuous monitoring of client’s proposal.

Yes, we’ve agreed that with the client’s that we’re going to analyze their portfolio on a quarterly basis with an annual review.

Number Three: What documentation are you providing as proof of continuous monitoring?

Once we get into continuous monitoring, we will provide the client with an overview snapshot of where they are towards achieving their goal and what they need to do is any changes are to be made, to make sure that we can better accomodate them achieving their goal within their risk tolerance profile.

Have any questions?